The former chairman of Sotheby’s auction house was sentenced to a year and day in prison and fined $7.5 million on Monday, for his part in an illegal price-fixing agreement with rival firm Christie’s. Although he has resigned as Sotheby’s chairman, self-made US billionaire Alfred Taubman – who is worth an estimated $450 million – remains the auction house’s major shareholder.

A US District Court Judge told Taubman: “No one is above the law” as he issued the sentence. “This was not a crime motivated by desperation and need, but arrogance and greed,” he said.

The case has scandalised the art world and is a black mark in Sotheby’s 257-year history. Sotheby’s and Christie’s have traditionally handled sales for celebrities and royalty, such as Princess Salimah Aga Khan and the late Princess Diana. Prosecutors had charged both firms – who together control 90 per cent of the world’s live auction market in art, jewellery and furniture – with colluding to fix prices from 1993-1996. Sotheby’s has already paid a $45 million fine after pleading guilty to an antitrust charge.

The defence had pulled out the stops to prevent 78-year-old Taubman serving jail time, producing testimonial letters from former US President Gerald Ford, Queen Noor of Jordan and former US Secretary of State Henry Kissinger. Taubman’s lawyers said jailing the billionaire, who suffers from a string of ailments, would be tantamount to a death sentence. Judge George Daniels dismissed the claims saying Taubman had been the driving force behind the conspiracy.

However, the judge did agree to add an extra day to Taubman’s sentence, making him eligible for time off for good behaviour. The US Justice Department had argued that Taubman should face a full three-year sentence.

The two auction houses fixed the fees they charged after Taubman met his opposite number at Christie’s, Sir Anthony Tennant. Sir Anthony, however, has refused to answer the charges and cannot be extradited. Other Christie’s staff were granted immunity from prosecution after agreeing to testify against Sotheby’s and providing the documents needed to prove fraudulent intent.

Much of the prosecution’s case rested on the testimony of Taubman’s former Chief Executive, Diana “Dede” Brooks, who said she had been ordered by Taubman to conspire with Christie’s executives to fix the commissions they charged their clients.

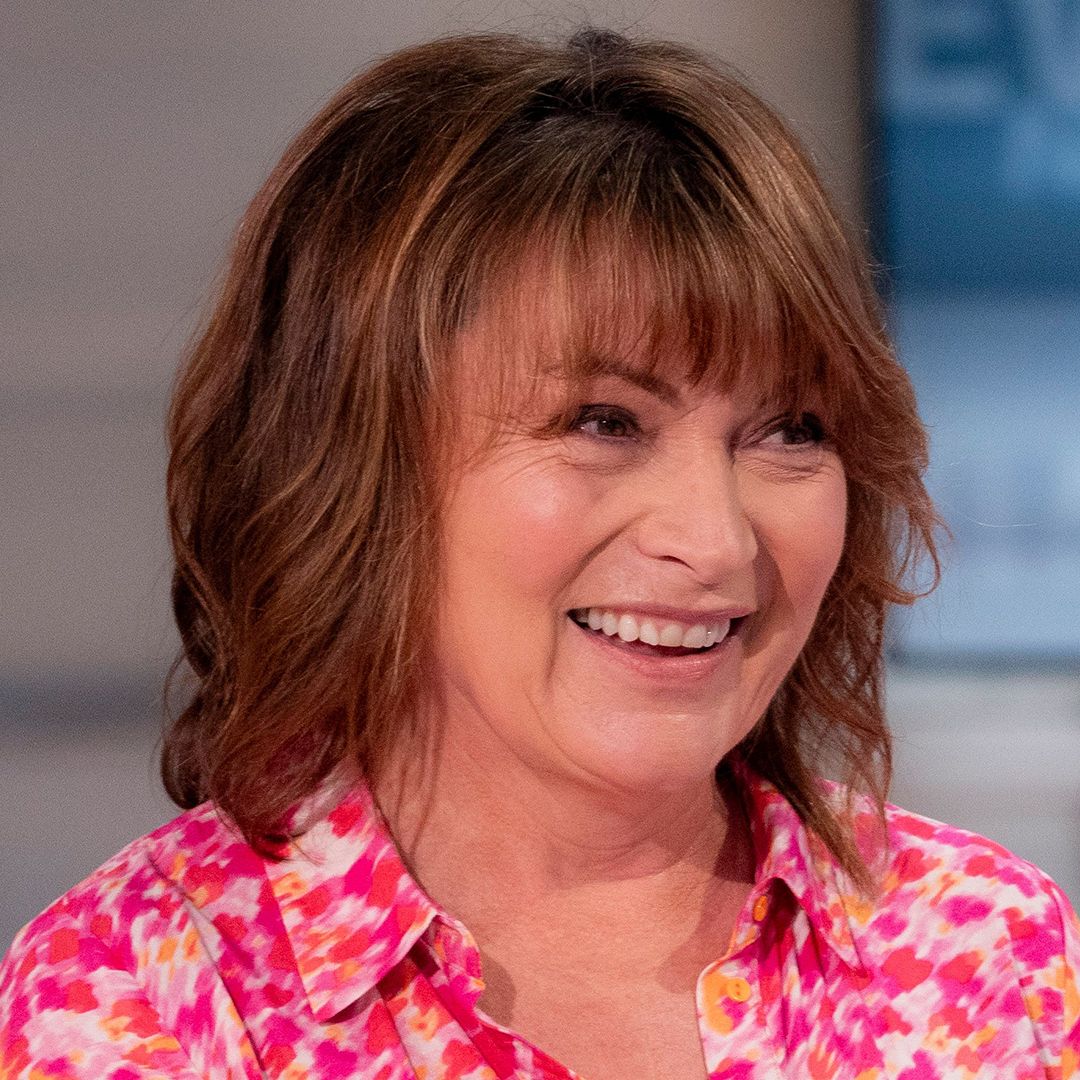

Photo: © Alphapress.com

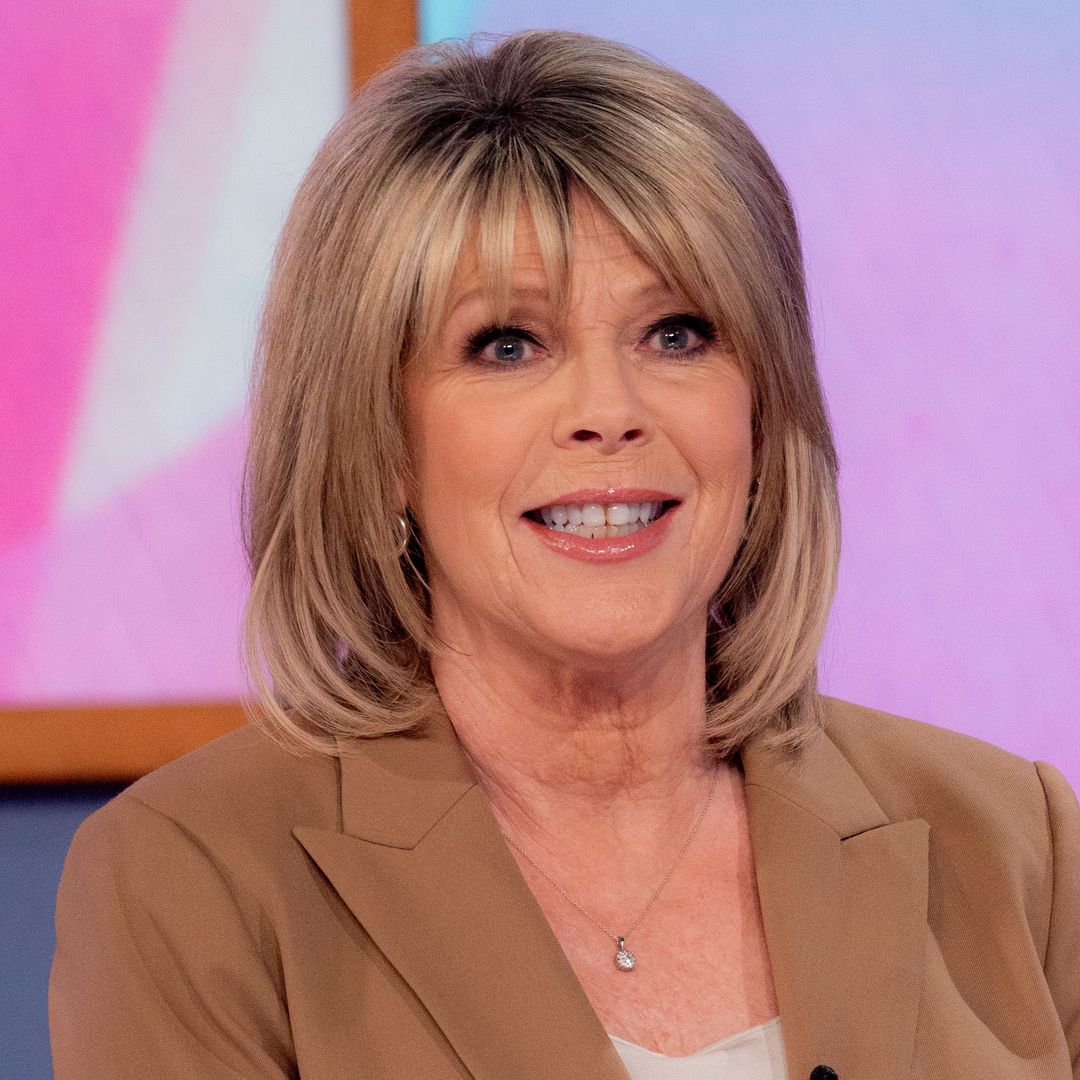

Photo: © Alphapress.com