Martin Lewis has slammed reports which suggest he walked off Good Morning Britain "in a huff". The This Morning money saving expert was accused of storming off Thursday's show after he was cut off mid-explanation by GMB hosts Ranvir Singh and Adil Ray.

WATCH: Martin Lewis reassures wife Lara Lewington following hilarious on-air gaffe

Taking to Twitter at the end of the day, Martin rubbished the claim and said: "This is utter tosh. I didn't walk off @gmb in a huff (you would know if I really was annoyed). "It was clearly done in jest, quite deliberately so they could see I had shorts on following the 'appropriate work video confirmed clothes' discussion," he added.

WATCH: Martin Lewis apologises after wife Lara Lewington's hilarious on-air gaffe

On the show, the 48-year-old was discussing how people who are working from home can claim back a tax-free allowance. He told viewers that UK interest rates are currently below their 25-year prior low and that savings interests are "absolutely dire".

However, when Martin moved on to talk about MOTs restarting, GMB host Ranvir tried to interrupt. "Martin, we'll have to leave it there," added Adil, to which Martin jokingly zipped up his mouth and said: "Zip, programme's over, bye!"

MORE: Martin Lewis and wife Lara enjoy rare date night as lockdown eases

Viewers were quick to see the funny side, with one fan replying to Martin's tweet: "It made me laugh, as I am also a short wearing teams/zoom/Google meet type of man." Another remarked: "I watched live. It was totally in jest. Ignore them. You're doing an amazing job keeping everyone informed and safe. Thank you #knighthood must be coming."

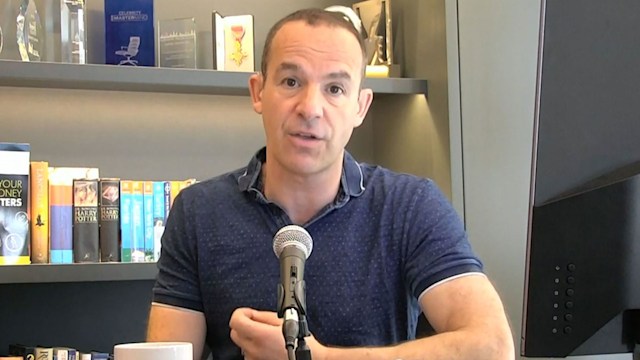

The This Morning star hit back at the claim

During the course of the pandemic, the financial expert has naturally been helping people with their money problems throughout lockdown. He recently announced to his followers that stamp duty has been cancelled, tweeting: "Stamp duty cut IMMEDIATELY."

He added: "No stamp duty paid on homes up to £500,000 (currently £125,000). That's huge. Runs until 31 March 2021. That will help many, but not first time buyers with sub 10% deposits who simply will struggle to get mortgages."