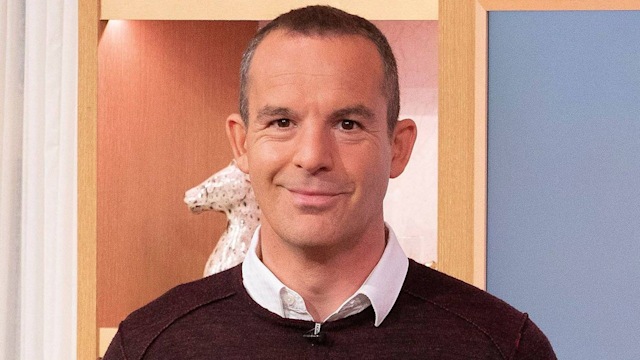

Christmas is nearly here and no doubt you're up to your ears in present shopping for the kids or grandchildren. It can be tempting to go all out on new toys, but sometimes children enjoy receiving cash just as much – plus it's a good opportunity to teach them the value of money and how to save. Choosing the right savings account can be a minefield though… which is the best savings account right now, what about larger sums and are Junior ISA's still good value? Thankfully, MoneySavingExpert's Martin Lewis has compiled a helpful guide and he suggests getting older kids involved in the process too.

WATCH: The next generation of royals

Martin said: "Everyone knows I’m a big fan of financial education for kids – not only in teaching them how to save, but importantly where to save to get the most from their money." He adds: "If they’re old enough, sit down with them, and pick the savings account together, running through the pros and cons of each. Turn it into a fun financial game."

The top savings accounts

Halifax Kids' Regular Saver account

According to Martin, his 'easy winner' is the Halifax Kids' Regular Saver account, which pays 4.5% AER fixed for a year and is up to age 15. Children can pay in between £10 - £100 every month and it can be opened and accessed either online or at a branch. It's great as you can miss months if you want, however you can't take out money until the end of the first year, when the rate falls. Martin then advises moving savings to an account with a better rate.

MORE: 8 parenting techniques Victoria Beckham swears by

Saffron Building Society

An alternative, suggests Martin, is the Saffron Building Society which pays 4% AER, although there is no online access – you need to open and manage the account either in branch or by post. The account does allow withdrawals.

Easy access savings accounts

HSBC MySavings account

There are a few options when it comes to saving larger sums of money. Martin recommends HSBC's MY Savings account which pays 3% AER on funds up to £3,000 and offers unlimited withdrawals. From age 11, your child also gets a MyAccount with a Visa debit card and online access.

Santander 123 Mini

For children aged between 11-18, the Santander 123 Mini account is a good option, reveals Martin. Your child will get 3% on £300-£2,000 plus a contactless debit card. Those under 13 need a Santander current account and the savings account needs to be opened in the branch.

MORE: Kids' Gift Guide: Top present ideas for Christmas day

TSB Under-19s account

This TSB account is great for teenagers as it can be opened by those 11-18 and comes with a cash card for withdrawals or a Visa debit card for shopping. It pays 2.5% interest on funds up to £2,500.

Virgin Money Young Saver account

If your child is a BIG saver, then the Virgin Money Young Saver account is for them. He or she can put away up to £25,000 at a rate of 2.25AER and there are unlimited cash withdrawals. Martin warns though that the rate is variable and could drop. "So with older children, turn this into a game, by giving them the responsibility to check the rate and see if they can earn more elsewhere to get a better rate."

Junior ISA savings accounts

These are a different type of account where you can save up to £4,368 per year tax-free but the money is untouchable until your child turns 18. Martin says the top-paying JISA cash account is the Coventry Building Society which pays 3.6% AER.

For more information visit moneysavingexpert.com