As a business reporter, I’m well versed in everything from inflation to interest rates and investing - and now I’ll be bringing you practical financial advice with the help of leading female experts in the industry. Each week, I’ll be addressing topical money matters, empowering you to take control of your savings and make well-informed financial decisions.

The cost of living crisis has hit the UK hard. 2023 will be remembered as the year the price of our weekly food shop spiralled out of control, not to mention mortgage rates soaring and energy prices skyrocketing, leaving us with very little disposable income.

And now, the UK inflation rate is falling - and it’s going to affect your food bill, mortgage and energy prices. Inflation is the rate of price increase over a given period of time and the UK inflation rate is currently hovering at about 4.7%.

But what does this mean for you on a practical level? Here’s how the falling inflation rate will actually affect you in 2024…

Your food prices

Just because inflation is falling, don't expect to see a decrease in the cost of your food bill.

Prices are still rising quickly in comparison to a year ago, only at a slower rate than they have been.

Dr Leah Downey, an economist and research fellow at Cambridge University, explains: "Inflation on food has dropped, but it's still inflation rate so food prices are still going up. They're just going up less fast than they were before. That’s important to note.

“People are still going to see high food bills and the food prices in this most recent numbers, October 2023 are still 30% higher than they were in October 2021. So it's a significant change for people."

Your mortgage rates

Higher inflation can also lead to increased borrowing costs for banks and financial institutions. This can result in lenders passing on these increased costs to borrowers in the form of higher mortgage interest rates.

Mortgage lenders change their fixed mortgage rates on the back of expected funding costs, which are ultimately tied into the market's predictions about how high the base rate will ultimately go. This is in turn closely linked to the outlook for inflation.

The more inflation falls, the more confident markets will become that interest rates will be cut in the near future.

Dr. Leah also had this to say. "Given that the inflation rate in the UK has been dropping, which is what the Bank of England wants to see, I do think we hopefully won’t be seeing interest rates going up any time soon. But I also think it's unlikely to come down in the near future because the Bank of England really wants to be cautious."

So concerned mortgage owners needn’t worry too much just yet…

Your savings

Higher interest rates could mean good news for some savers.

"It could affect savings rates. But it might be worth shopping around a bit and looking at other possible places to put your savings because some rates will be going up, but not all of them," Dr Leah says.

Metro Bank, Natwest and Santander are just some of the banks offering easy-access accounts with a rate just slightly above 5%.

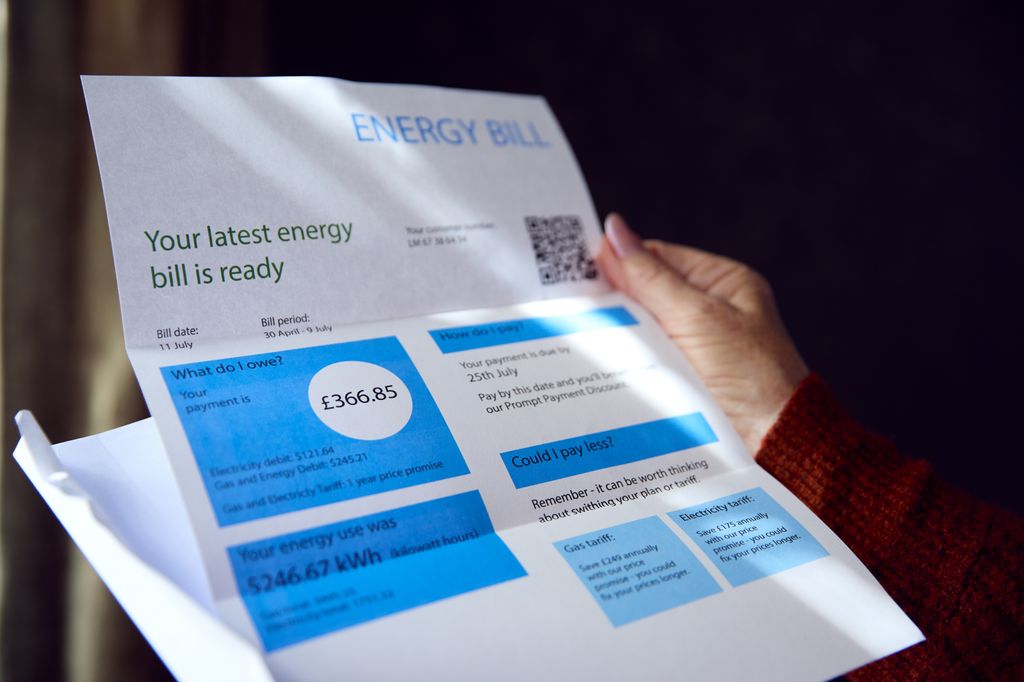

Your energy bills

I hate to be the bearer of bad news, but your energy bills are expected to go up again… although not because of the fall of inflation.

"Even though we've seen this major drop in the energy contribution to inflation they're still 60% higher than they were in October 2021," Dr Leah explains.

LONG READ: How taking control of my finances helped me find my confidence

The increase in bills is actually down to the UK Energy regulator Ofgem are increasing the energy price cap by 5%. The price cap is the maximum that energy suppliers can charge you for your energy bills.

What this all means is that the average household will now pay an additional average of £94 annually. But experts predict that the price cap will fall again in March.