Autumn is well and truly here: the temperature has dropped, nights are closing in, and - dare I say it - the C word has started to make its presence known on the shelves at the local supermarket. Plus, there's always that back-to-school feeling in the air when September arrives regardless of how long it is since you actually went to school.

There's something about the change in season that signals a new start and when it comes to your finances, there's never a bad time to make a change, so here are some ways to kick start a new season for your financial health.

Make it easy and automate

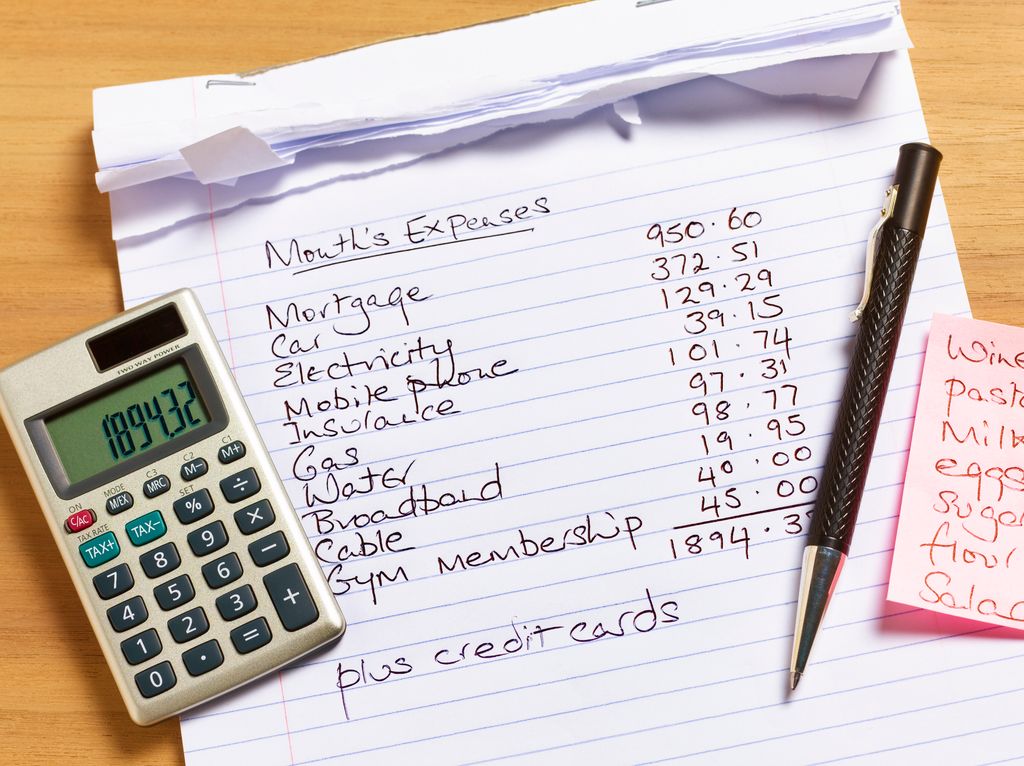

Life often feels like it's moving at one hundred miles an hour and at the end of a long week, the last thing you probably want to do is sift through your bank statements to review your spending. When we've got an endless to do list, prioritising our financial health and making better decisions can slip down the list of things to do and get pushed week after week, but there is a simple solution: automating your finances.

Setting up automatic payments can save you a whole lot of time when it comes to both saving and spending. It can even save you money too. Especially if you have a credit card that you use regularly, or there are payments you make on a monthly basis such as utilities, setting up a direct debit to automatically go from your current account can avoid any risk of missing a payment. One of the biggest events that can negatively impact your credit score is a missed payment, so automating payments can save all sorts of unwanted stress.

Automation is a quick win when it comes to saving and investing as well as spending. Paying yourself first is a tried-and-tested method to prioritise your future finances, rather than waiting to see if you have any money left at the end of the month to save (spoiler alert: you probably won't).

To pay yourself first, set up a standing order for the day after your usual payday so that every month, you send a set amount of money into your savings and investments in the same way that you pay your bills. It might sound crazy, but it’s a way to ensure you set aside funds for your future, whatever the amount.

Think long-term over quick fixes

Over the last few years, we've all witnessed rapid inflation and the cost of living crisis. The result has been tighter purse strings and for many, spending decisions have been dictated by the cheapest option available. Although sometimes it may not be an option, it’s worthwhile considering that saving money in the present may not turn out to be the best financial decision overall. In fact, there are plenty of examples where the cheapest option can turn out to be far more costly than originally planned.

Let’s take housing as an example: rental costs have skyrocketed over the last year or so, especially in major cities. It may be tempting to choose an option further out of a city in order to find more space and accept a longer journey to your workplace to save money, yet in some circumstances, this may wind up as a far more costly option. If you work from home and discover that in your local area you don’t have a fast and stable internet connection, you can end up spending a fortune for coffee shop internet on a daily basis.

The same principle can apply to items you buy as well. Shoes are a prime example of a purchase that it can be worth spending a little more on for quality, as poorly made shoes often don’t last long and can cause a lot of discomfort along the way!

Start small and start now

When it comes to money, the sooner you pay attention the better. Starting to keep an eye on your money and thinking about your financial future now, whatever your circumstances, gives you more time to make informed decisions and set yourself up for the future.

RELATED: Self-sabotaging your bank balance? Here's why

It can be tempting to wait until the next pay rise, or until you've paid off your credit card, or until your next birthday - but the truth is, there will always be a reason to put off starting to improve your finances and time really is your greatest asset in changing your financial situation. So, stop saying 'when' and start today.

Ellie Austin-Williams is the author of Money Talks, a Lifestyle Guide for financial wellbeing. Find her on Instagram at @thisgirltalksmoney.